French income tax calculator

This calculator allows you to calculate income taxes and social contributions equivalent for France. It is charged at a rate of 97 on 9825 of gross salary if it does not exceed EUR164544 2020 ceiling per year and on 100 of the portion of the gross salary that exceeds EUR164544.

Salary After Tax Calculator September 2022 Incomeaftertax Com

The france income tax calculator uses income tax rates from the following tax years 2021 is simply the default year for this tax calculator please note these income tax tables only include.

. To calculate for joint incomes if you calculate the average income enter this figure and then double the resulting Tax you will achieve the correct result France Income Tax Calculator -. The amount of income tax levied on your 2021 income declared on your 2022 tax return ranges from 0 to 45 and is calculated based on. France Monthly Salary After Tax Calculator 2022.

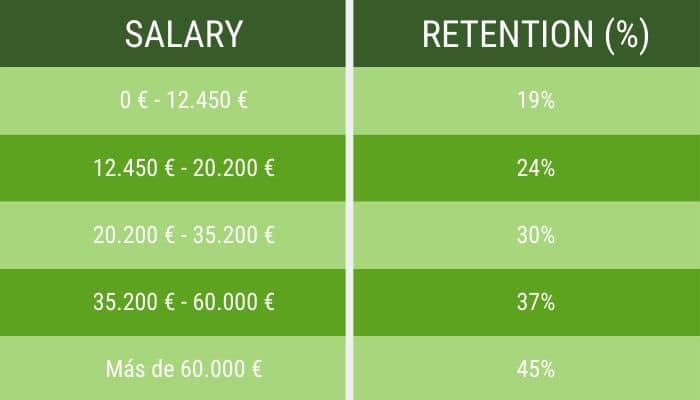

You can choose the preferred currency for the input amounts and displayed calculation. Rates are progressive from 0 to 45 plus a surtax of 3 on the portion of income that exceeds 250000 euros EUR for a single person and EUR 500000 for a married couple. Thats why we have created this tool in order to help you estimate your personal income tax burdern in France based on the latest fiscal data from the French authorities for 2019.

Simply enter your annual or monthly income into the salary calculator above to find out how taxes in France affect your income. French Income Tax Rates 2022. France Salary Tax Calculator 2022.

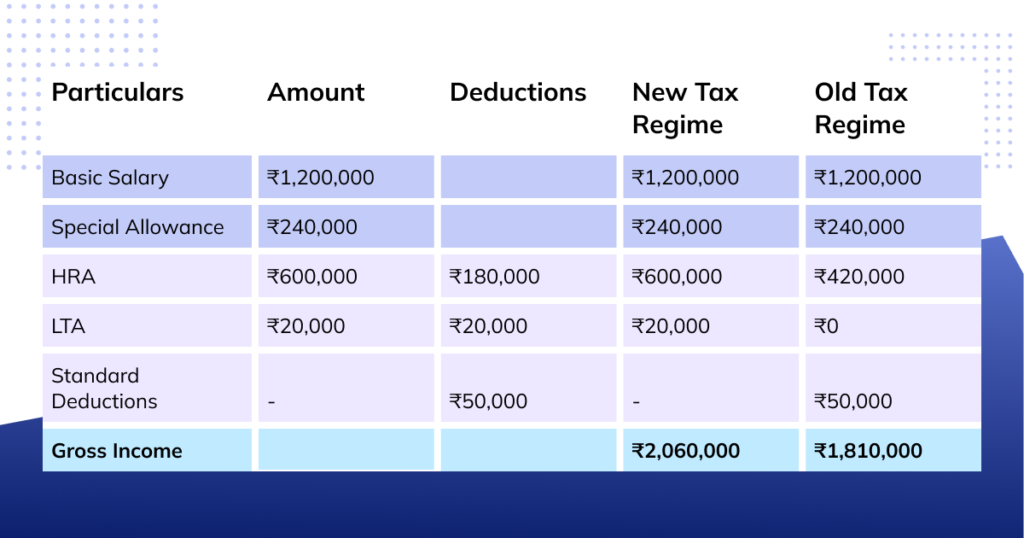

Income bracket up to 10064 taxed at 0 0 Income bracket 10 064 to 25 659 taxed at 11. 7 rows France - Individual - Sample personal income tax calculation France Individual - Sample personal income tax calculation Last reviewed - 14 February 2022 Example. Youll then get a breakdown of your total tax liability and take.

The formula is then 85000 x 03 - 607805 x 2 13344 tax payable. In additiona to the standard tax tables France also applies a surtax on personal income when it passes a certain threshold. 8 586 obtained by calculating 18 650 10 064 x 11 94446.

The Monthly Wage Calculator is updated with the latest income tax rates in France for 2022 and is a great calculator for working out your. The PIT Personal Income Tax Surtax rates and. The total income is divided by 2 so 850002 42500 and therefore within the 30 tax band on marginal income.

As a non-resident french income that you earned after leaving france liable for tax in france under the international tax treaty signed between france and your country of residence will be taxed. Fill in the relevant information in the France salary calculator below and we will prepare a free salary calculation for you including all costs that. Non-residents usually pay tax on their France-sourced income at a minimum French tax rate of 20 for French-sourced income up to 27519 and 30 for income above this.

Sales Tax Calculation Software Avalara

How Much Does A Small Business Pay In Taxes

Personal Income Tax Solution For Expatriates Mercer

France Cryptocurrency Tax Guide 2021 Koinly

How To Calculate Foreigner S Income Tax In China China Admissions

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Fr Income Tax Calculator September 2022 Incomeaftertax Com

French Income Tax How It S Calculated Cabinet Roche Cie

Personal Income Tax Solution For Expatriates Mercer

Income Tax In Spain Exact Percentages Allowances

Wealth Tax In France Keep Up With All The Changes Axis Finance Com

What S The Tax Scale On Income Service Public Fr

French Income Tax How It S Calculated Cabinet Roche Cie

Getting A Tin Number In France French Tax Numbers Expatica

How To Calculate Income Tax On Salary With Example

French Income Tax How It S Calculated Cabinet Roche Cie

How To Calculate Foreigner S Income Tax In China China Admissions